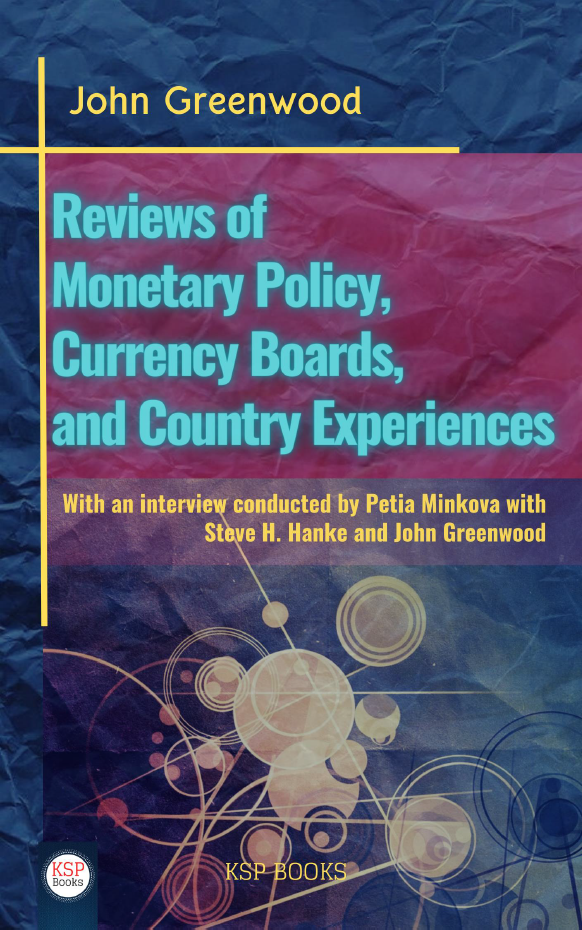

Editor

Steve H. Hanke

The Johns Hopkins University, USA.

e-ISBN: 978-625-7813-50-1

Publishing Date: December 15, 2020

File Size: 4130 MB

Length: xvii + 196 pages (PDF)

Language: English

Dimensions: 13,5 x 21,5 cm

This Book is completely open access. You can freely read, download and share with everyone.

This Book is completely open access. You can freely read, download and share with everyone.

In 1995, I founded the Johns Hopkins Institute for Applied Economics, Global Health, and the Study of Business Enterprise. One of the purposes of that research institute was to continue a research program on currency board systems, which was established in the early 1980s. The program has included the works of many leading experts on currency boards and has benefitted enormously from the involvement of my former post-doctoral student and long-time collaborator Dr. Kurt Schuler.

Many of the papers in this volume focus on various aspects of currency boards. They are original because they are based on primary data. Indeed, the Johns Hopkins research program on currency boards, which is directed by Dr. Schuler and me, has now collected and digitized all of the financial data for virtually all of the currency boards that have ever existed. So, just what is a currency board?

An orthodox currency board issues notes and coins convertible on demand into a foreign anchor currency at a fixed rate of exchange. As reserves, it holds low-risk, interest-bearing bonds denominated in the anchor currency and typically some gold. The reserve levels (both floors and ceilings) are set by law and are equal to 100%, or slightly more, of its monetary liabilities (notes, coins, and, if permitted, deposits). A currency board’s convertibility and foreign reserve cover requirements do not extend to deposits at commercial banks or to any other financial assets. A currency board generates profits (seigniorage) from the difference between the interest it earns on its reserve assets and the expense of maintaining its liabilities.

By design, a currency board has no discretionary monetary powers and cannot engage in the fiduciary issue of money. It has an exchange rate policy (the exchange rate is fixed) but no monetary policy. A currency board’s operations are passive and automatic. The sole function of a currency board is to exchange the domestic currency it issues for an anchor currency at a fixed rate. Consequently, the quantity of domestic currency in circulation is determined solely by market forces, namely the demand for domestic currency. Since the domestic currency issued via a currency board is a clone of its anchor currency, a currency board country is part of an anchor currency country’s unified currency area.

Several features of currency boards merit further elaboration. A currency board’s balance sheet only contains foreign assets, which are set at a required level (or tight range). If domestic assets are on the balance sheet, they are frozen. Consequently, a currency board cannot engage in the sterilization of foreign currency inflows or in the neutralization of outflows.

A second currency board feature that warrants attention is its inability to issue credit. A currency board cannot act as a lender of last resort or extend credit to the banking system. It also cannot make loans to the fiscal authorities and state-owned enterprises. Consequently, a currency board imposes a hard budget constraint and discipline on the economy.

A currency board requires no preconditions for monetary reform and can be installed rapidly. Government finances, state-owned enterprises, and trade need not be already reformed for a currency board to begin to issue currency.

Currency boards have existed in about 70 countries. The first one was installed in the British Indian Ocean colony of Mauritius in 1849. By the 1930s, currency boards were widespread among the British colonies in Africa, Asia, the Caribbean, and the Pacific islands. They have also existed in a number of independent countries and city-states, such as Danzig and Singapore. One of the more interesting currency boards was installed in North Russia on November 11, 1918, during the civil war. Its architect was John Maynard Keynes, a British Treasury official responsible for war finance at the time.

Countries that have employed currency boards have delivered lower inflation rates, smaller fiscal deficits, lower debt levels relative to the gross domestic product, fewer banking crises, and higher real growth rates than comparable countries that have employed central banks.

Given the superior performance of currency boards, the obvious question is “What led to their demise and replacement by central banks after World War II?” The demise of currency boards resulted from a confluence of three factors. A choir of influential economists was singing the praises of central banking’s flexibility and fine-tuning capacities. In addition to changing intellectual fashions, newly independent states were trying to shake off their ties with former imperial powers. Additionally, the International Monetary Fund (IMF) and the World Bank, anxious to obtain new clients and “jobs for the boys,” lent their weight and money to the establishment of new central banks. In the end, the Bank of England provided the only institutional voice that favored currency boards.

Chapter 1

On extending the currency board principle in Bulgaria: Long live the currency board

S.H. Hanke & T. Tanev

Chapter 2

Remembrances from Montenegro’s momentous currency reform: The 1999 adoption of the German Mark

S.H. Hanke

Chapter 3

Analysis of the Estonian currency board

A. Katsis

Chapter 4

History, policies and financial statements of the Irish currency commission and the Central Bank of Ireland (1927–1979)

C. Wang

Chapter 5

Prospects for a currency board in Iceland

A. Mabie

Chapter 6

The currency board monetary system: The case of Malta (1939-1968)

L. Zhu

Chapter 7

The currency systems of the United Kingdom periphery

B. Dixon

Chapter 8

The constitutions (Founding laws) and comparable features of select currency boards in the former British Empire

B. Tsoi

Steve H. Hanke

The Johns Hopkins University, USA.

Dr. Steve H. Hanke is a Professor of Applied Economics and Founder & Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. He is a Senior Fellow and Director of the Troubled Currencies Project at the Cato Institute in Washington, D.C., a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing, a Special Counselor to the Center for Financial Stability in New York, a contributing editor at Central Banking in London,anda contributor at National Review. Prof. Hanke is also a member of the Charter Council of the Society of Economic Measurement and of Euromoney Country Risk’s Experts Panel. In addition, Prof. Hanke serves as a member of the Board of Directors of the United States National Board for Education Sciences.

In the past, Prof. Hanke taught economics at the Colorado School of Mines and at the University of California, Berkeley. He served as a Member of the Governor’s Council of Economic Advisers in Maryland in 1976-77, as a Senior Economist on President Reagan’s Council of Economic Advisers in 1981-82, and as a Senior Advisor to the Joint Economic Committee of the U.S. Congress in 1984-88. Prof. Hanke served as a State Counselor to both the Republic of Lithuania in 1994-96 and the Republic of Montenegro in 1999-2003. He was also an Advisor to the Presidents of Bulgaria in 1997-2002, Venezuela in 1995-96, and Indonesia in 1998. He played an important role in establishing new currency regimes in Argentina, Estonia, Bulgaria, Bosnia-Herzegovina, Ecuador, Lithuania, and Montenegro. Prof. Hanke has also held senior appointments in the governments of many other countries, including Albania, Kazakhstan, the United Arab Emirates, and Yugoslavia.

Related EconPedia Items