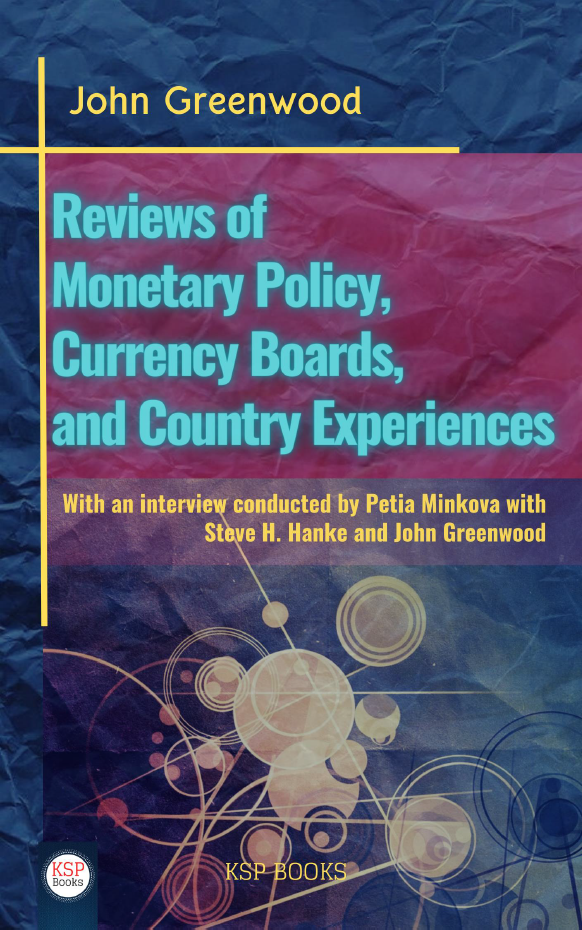

Editors

Steve Hanke

The Johns Hopkins University, USA

Bilal Kargı

Ankara Yıldırım Beyazıt University, Turkey

e-ISBN: 978-625-8190-80-9

Publishing Date: March 1, 2023

File Size: 4,237 MB

Length: xiii + 136 pages (PDF)

Language: English

Dimensions: 13,5 x 21,5 cm

This Book is completely open access. You can freely read, download and share with everyone.

This Book is completely open access. You can freely read, download and share with everyone.

It is possible to present a brief summary of the subjects that the chapters in this book focus on.

Ch 1. The Hanke-Krus World Hyperinflation Table first appeared in the authoritative Routledge Handbook of Major Events in Economic History, which was published in 2013. The table contained every country that had ever experienced a hyperinflation – all 56 of them. With this paper, we amend the Table and add a 57th entry: Venezuela. On December 3, 2016, Venezuela’s inflation met all the criteria required to qualify as a hyperinflation. Specifically, Venezuela’s monthly inflation rate exceeded 50 percent per month for 30 consecutive days.

Ch 2. This chapter examines Argentina’s Caja de Conversión in 1907 and 1908, when a financial panic affected a number of other financial markets. Through an analysis of the Caja’s monthly balance sheets (digitized in an accompanying workbook), it tests the degree of the Caja’s currency board orthodoxy and analyzes the effects of the panic on the Argentine economy.

Ch 3. We examine to what extent Bermuda’s monetary authorities have operated like currency boards, using statistical tests based on balance sheets and an analysis of Bermuda’s legislation. Our analysis indicates that in the early 20th century, Bermuda had a currency board system. In later years, problems with analyzing the balance sheet make a judgment based on statistical tests more difficult. We provide a companion spreadsheet workbook of annual or semiannual data of the monetary authority for the past 100 years.

Ch 4. The Cayman Islands and Hong Kong are two of the world’s great financial centers. They both owe a great deal of their success to the fact that they employ currency boards. Their currency boards allow them to issue the Cayman and Hong Kong dollars. Both of these domestic currencies are, in fact, clones of the mighty U.S. dollar—the world’s dominant international currency. Currency boards have existed in over 70 countries. The first one was installed in the British Indian Ocean colony of Mauritius in 1849. By the 1930s, currency boards were widespread among the British colonies in Africa, Asia, the Caribbean, and the Pacific islands. They have also existed in a number of independent countries and city-states, such as Danzig and Singapore. One of the more interesting currency boards was installed in North Russia on November 11, 1918, during the civil war. Its architect was none other than John Maynard Keynes, a British Treasury official responsible for war finance at the time.

Ch 5. This chapter analyzes the historical background and current conditions relating to Venezuela’s economic crisis, focusing on its monetary and financial aspects. It aims to assist in making recommendations for appropriate monetary reforms, such as the establishment of an orthodox currency board or official dollarization. The paper addresses critical questions concerning such monetary reforms, as well as complementary economic reforms that would improve Venezuela’s troubled economy in the near future.

Ch 6. We provide a historical summary, legislative history, and the first spreadsheet data series of the British Honduras Board of Commissioners of Currency (1894-1976) and examine to what extent it operated as a currency board using statistical tests. This paper makes the annual balance sheets of the currency board available in machine-readable form for the first time, in a companion spreadsheet workbook.

Ch 7. This chapter was part of a larger project to determine how currency board monetary systems have performed. The goal was to find information about the note issue of Argentina’s Banco de la Provincia in the mid 1800s in order to determine if Argentina had a currency board system. I also tried to find answers to the questions of why the note issue arrangement was established, how it worked organizationally and why it was replaced. The majority of the information I found came from the book El Banco de la Provincia by Osvaldo Garrigos. Other accounts of this period include Straining at the Anchor: The Argentine Currency Board and the Search for Macroeconomic Stability by Gerardo della Paolera and Alan Taylor and La economía argentina en el largo plazo by Roberto Cortés Conde, but they are less detailed in their descriptions of the history of the Banco de la Provincia.

Preface

Venezuela enters the record book: The 57th entry in the Hanke-Krus World Hyperinflation Table

Steve H. Hanke & Charles Bushnell

How the panic of 1907 passed Argentina by

Alexandra Popkin

The currency board monetary system over 100 years in Bermuda (1915-2015)

John Stanton

The Cayman Currency Board, An Island Of Stability

Steve H. Hanke & Edward Li

Issues in Venezuelan Monetary and Economic Reform

María Belén Wu

Currency Board Monetary System: The Case of British Honduras (1894-1976)

Preston Wessells

Did Argentina Have a Currency Board in the Mid 1880s?

Adria Haimann

Steve Hanke

The Johns Hopkins University, USA

Dr. Steve Hanke is a Professor of Applied Economics and Founder & Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. He is a Senior Fellow and Director of the Troubled Currencies Project at the Cato Institute in Washington, D.C., a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing, a Special Counselor to the Center for Financial Stability in New York, a contributing editor at Central Banking in London and a contributor at the National Review.

Bilal Kargı

Ankara Yıldırım Beyazıt University, Turkey

Dr. Bilal Kargı is Associate Professor of Economics at Ankara Yıldırım Beyazıt University, Turkey.

Related EconPedia Items